Singapore’s Mass Rapid Transit (MRT) system is the lifeline of the city, directly influencing property demand, rental potential, and quality of life. With the Thomson-East Coast Line (TEL) now fully operational, areas like Springleaf, Woodlands, and Marina Bay are experiencing renewed interest from homebuyers and investors.

This article examines:

✅ Why MRT proximity enhances property appeal

✅ How the TEL is reshaping Singapore’s connectivity

✅ Why renters and investors favor MRT-accessible properties

1. The Value of Living Near an MRT Station

A. Unmatched Convenience & Time Savings

- Singaporeans spend over 80 minutes daily commuting (LTA Survey 2023). Living near an MRT station reduces travel time significantly.

- Walk-to-station accessibility eliminates reliance on buses or taxis.

B. Stronger Rental Demand

- Expatriates and professionals prioritize MRT-linked homes for seamless commutes.

- Higher occupancy rates – Tenants are willing to pay premium rents for convenience.

C. Long-Term Investment Potential

- Historical trends show MRT-linked properties appreciate faster than those further away.

- Future infrastructure developments (e.g., new MRT lines, commercial hubs) further boost value.

D. Reduced Transportation Costs

- Rising COE and ERP prices make MRT living a cost-effective choice.

- Families save significantly by minimizing car dependency.

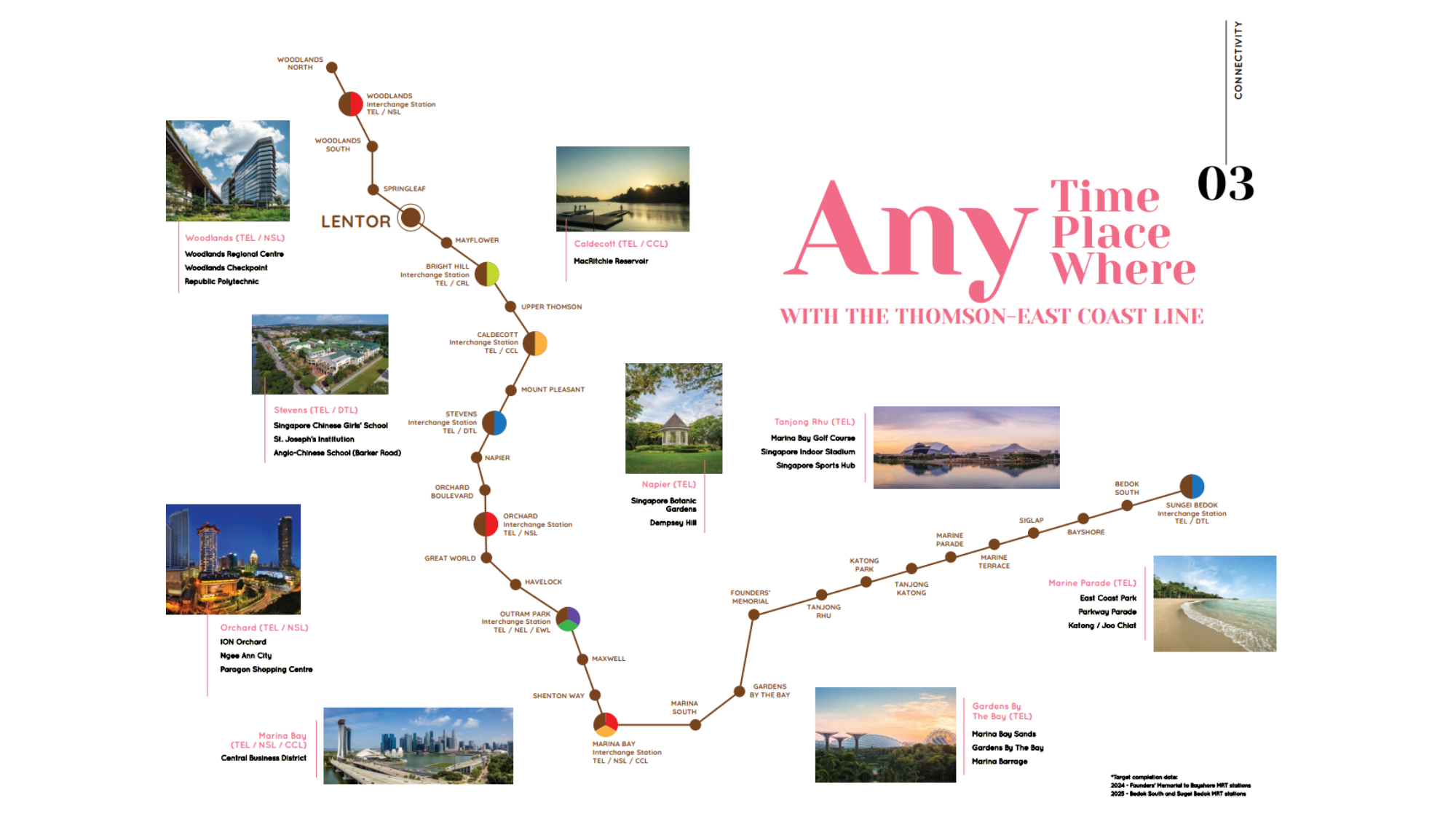

2. The Thomson-East Coast Line (TEL) – Transforming Singapore’s Connectivity

The TEL, fully operational since 2025, is Singapore’s sixth MRT line, connecting Woodlands to Suntec City with 32 stations. Here’s why it’s a game-changer:

A. Enhanced North-South Connectivity

- Direct links between Woodlands, Springleaf, Upper Thomson, Orchard, and Marina Bay in under 30 minutes.

- No transfers needed for key destinations.

B. Revitalizing Emerging Neighborhoods

- Areas like Springleaf and Lentor, previously car-dependent, are now high-demand residential zones.

- Woodlands North will benefit from the future Johor Bahru-Singapore RTS link, boosting cross-border appeal.

C. Rental Growth Along the TEL

- Properties near TEL stations (e.g., Orchard, Marina Bay) have seen 8-15% rental increases due to corporate tenant demand.

- Springleaf’s upcoming developments are attracting renters seeking affordable yet well-connected homes.

D. Sustainable and Car-Lite Living

- TEL encourages reduced car usage, aligning with Singapore’s green initiatives.

- More walking-friendly neighborhoods with improved amenities.

3. Where to Consider Along the TEL?

| Neighborhood | Key Appeal |

|---|---|

| Springleaf | First-mover advantage, upcoming residential launches, tranquil yet connected. |

| Woodlands North | Future RTS link to Johor Bahru, cross-border potential. |

| Orchard Boulevard | Luxury condo demand, strong expat rental market. |

| Marina Bay | Proximity to financial district, high rental yields. |

4. Why Springleaf Residence Stands Out

While resale data isn’t available yet (as it’s a new launch), Springleaf Residence offers:

- Direct access to Springleaf MRT (TEL), ensuring excellent connectivity.

- Limited new supply in the area, enhancing long-term value.

- A rare blend of nature and urban convenience, with Lower Seletar Reservoir and Springleaf Nature Park nearby.

For investors, this presents a prime opportunity to enter before the neighborhood matures further.

5. The Verdict: MRT Proximity = Smart Living & Investing

- Homeowners enjoy effortless commutes and future-ready living.

- Investors benefit from high rental demand and long-term capital growth potential.

- The TEL has reshaped property demand—making MRT-linked homes a top choice.

Interested in Springleaf Residence? Be among the first to secure a unit in this high-growth, well-connected location.

📞 Contact us today for VIP previews and pricing details!